ilovecreatives Information for COVID-19 loans and unemployment

Breaking it Down: COVID-19 Loans & Money

Updated May 1st, 2020

— Added Directory

— Added Unemployment Guide

— Added update to PUA

— Added 🆕to indicate what we’ve added (CTRL F)

If you’re a freelancer or small business owner, you may be eligible for federally-guaranteed loan(s) and/or monies from the government.

Damn, we’re not going to lie – these are wild times. Whether you’re in the gig-economy or you’re a small business owner, we know how much this pandemic has disrupted your plans…and bills.

Thankfully, we have the best community around, and our friend Mathieu Young, Founder of The Art of Freelance, is on the case and helping us drop knowledge on your options.

Disclaimer: this was NOT written by a CPA/lawyer/banker, and is based on articles found on the internet, so please do your own due diligence about any and all of this.

Page directory ☎️

Want us to send you updates?

It’s super hard to keep track of everything, we’ll be updating this page as frequently as possible, but if you would like us to send you updates, please sign up 👉🏼

But first —

Which Monies💸 do I qualify for?

👩🏻💻= Contractor, Sole-Proprietor, has 1099(s)

👩🏻💼= Employee has at least one W2 from 2019

🧑🏻💼= Pays employee(s) (does not include paying contractors)

1a. Paycheck Protection Program (PPP) 🧑🏻💼

This forgivable loan is available to all small businesses who have been in business since Feb 15, 2020 and employ fewer than 500 employees (full-time, part-time, or seasonal). Sole proprietors, independent contractors, and folks who are self-employed are also eligible if they have employees.

Long story short: If you have (or had) employees, apply. The government is giving you money (whether or not you are doing well) to keep your employees paid.

1b. Employee Retention Credit (ERC) vs. PPP 🧑🏻💼

This is $10K max per employee, but no paperwork, admin, and it’s for now until 12/31/2020. You get the credit every quarter on payroll tax. Use this calculator to compare PPP and ERC side by side since you may only take advantage of one or the other, it is important to make an informed decision.

Long Story Short: If your gross receipts declined by more than 50% compared to the same quarter in the prior year (and continuing until gross receipts are at least 80% of the comparable quarter in the prior year, up to 4 quarters).

2. Economic Injury Disaster Loan (EIDL) 🧑🏻💼👩🏻💻

Small businesses, freelancers and non-profits This program promises an advance of up to $10,000 on unsecured working capital loans. Businesses may apply for up to $2 million. Applications opened to small businesses (fewer than 500 employees for most industries) on April 3 and to independent contractors on April 10.

The SBA’s site says “funds will be made available following a successful application. This loan advance will not have to be repaid.” However, the loans must be used for fixed debts, such as rent; payroll; accounts payable; some bills the business cannot pay as a result of COVID-19’s impact.

Long story short: If you are a small business or contractor that has rent, bills, accounts payable (amounts due to vendors or suppliers for goods or services received that have not yet been paid for), or bills that cannot be paid as a result of covid-19’s impact, apply!

3a. Unemployment Insurance (UI) 👩🏻💼

Anyone that has been recently laid off and has a W2 from 2019. Even if you contracted for most of the time 2019, but have at least one W2, apply for unemployment. Contractors that have only 1099s, please see Pandemic Unemployment Assistance (PUA) below.

Long story short: if you’ve lost work due to COVID-19 (furloughed or laid off) and have at least one w2 from 2019, you should apply for unemployment benefits with your State ASAP.

3b. Pandemic Unemployment Assistance (PUA) 👩🏻💼👩🏻💻

🆕California independent contractors can apply for unemployment beginning April 28, 2020 at 10AM. The PUA program covers workers who do not qualify for regular unemployment compensation, including independent contractors, gig workers, the self-employed, and individuals with insufficient work history to qualify for regular coverage. However, recipients can also include individuals who have exhausted their regular unemployment benefits and extended federal benefits, meaning that traditional employees may apply for PUA after all of their other unemployment benefit options have expired.

Long story short: Finally, freelancers can get some money! If you already ran out of unemployment money, you’ll get more.

5. Economic Impact Payment (EIP) 👩🏻💻👩🏻💼🧑🏻💼

Most individuals earning less than $75,000 will receive $1,200, plus $500 per dependent child, via direct deposit within 3 weeks of March 30.

Long story short: You’ll just see money in your bank account.

6. Loan Deferment vs. Forbearance 👩🏻💻👩🏻💼🧑🏻💼

With everything going on right now, many student, auto, and housing loan companies are offering their customers deferment or forbearance options.

Long Story Short: While both could be helpful, it is important to understand the distinction.

Great, I applied.

Where’s my money!?

💸Check out this Tracker.

Paycheck Protection Program (PPP)

The Paycheck Protection Program (PPP) applications begin on April 3rd for small businesses and April 10th for sole proprietors and contractors. It’s important to apply as soon as possible before funds run out.

What is the “Paycheck Protection Program (PPP)”?

As part of the government CARES Act, the $350B Paycheck Protection Program was created to help small businesses navigate COVID-19 by offering forgivable loans.

Get 2.5x your monthly payroll (up to $10 million) based on average monthly payroll costs for the 12 months before March 31, 2020 reported on your IRS forms 940 and 941.

100% forgivable, as long as the loan is put only towards eligible payroll, benefits, rent & utilities in the first 8 weeks, it does not need to be repaid. If you have layoffs & salary cuts, balance of funds roll into a 10-year loan at 4%, 6-12 month deferral on first payment, or you can give it back with no penalty.

WHO is eligible

All businesses who have been in business since Feb 15, 2020 and employ fewer than 500 employees (full-time, part-time, or seasonal). Franchises in the restaurant and hospitality industry with no more than 500 employees per location may be eligible too.

Sole proprietors, independent contractors, and folks who are self-employed are also eligible. They’ll be able to apply one week after other small businesses, on April 10, 2020.

WHO is not eligible

Companies or individuals who started businesses after February 1, 2020

Companies backed by venture capital portfolios

Companies with more than one investor that’s a business (invested under an EIN)

Cannabis or Religious businesses

How do I apply?

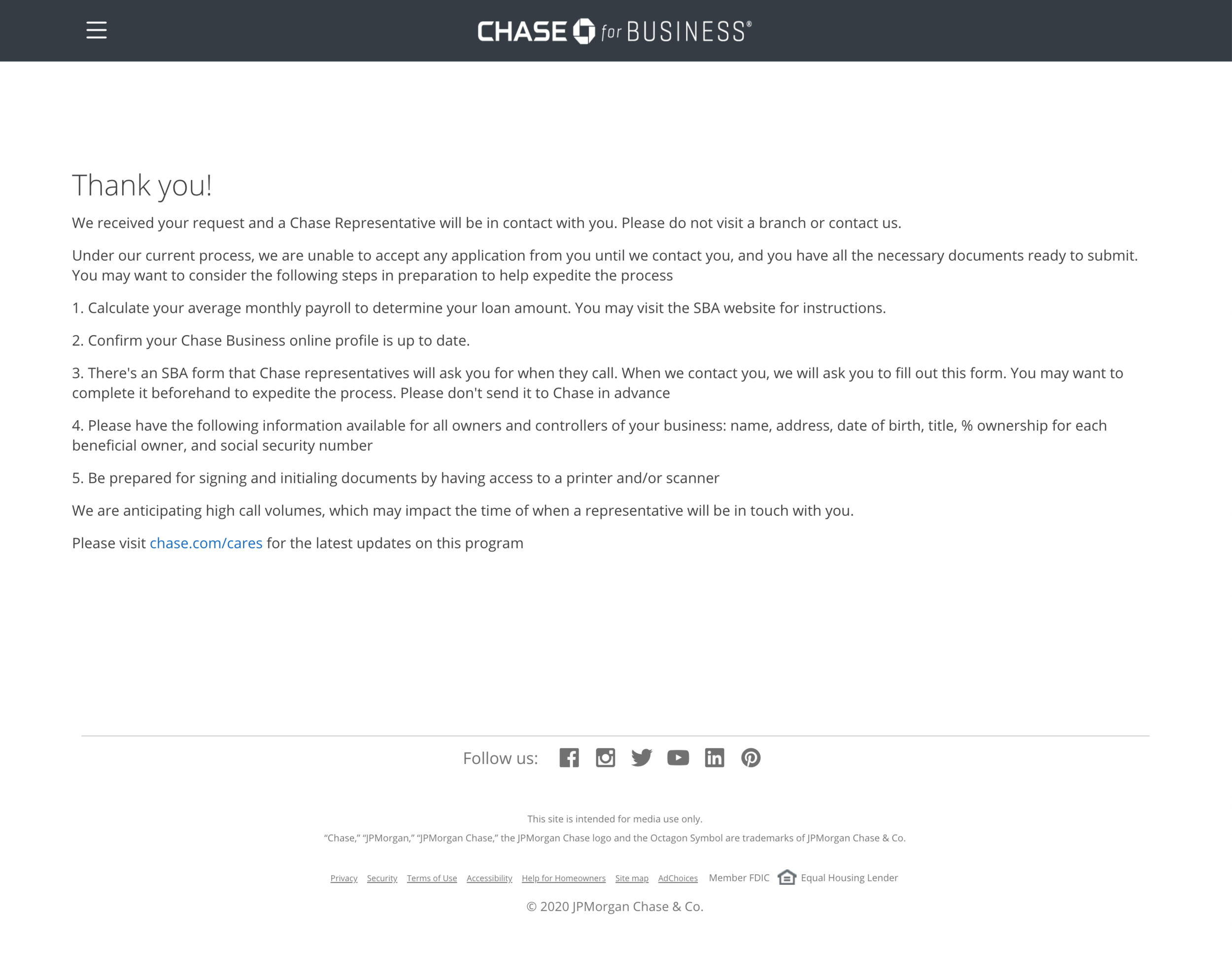

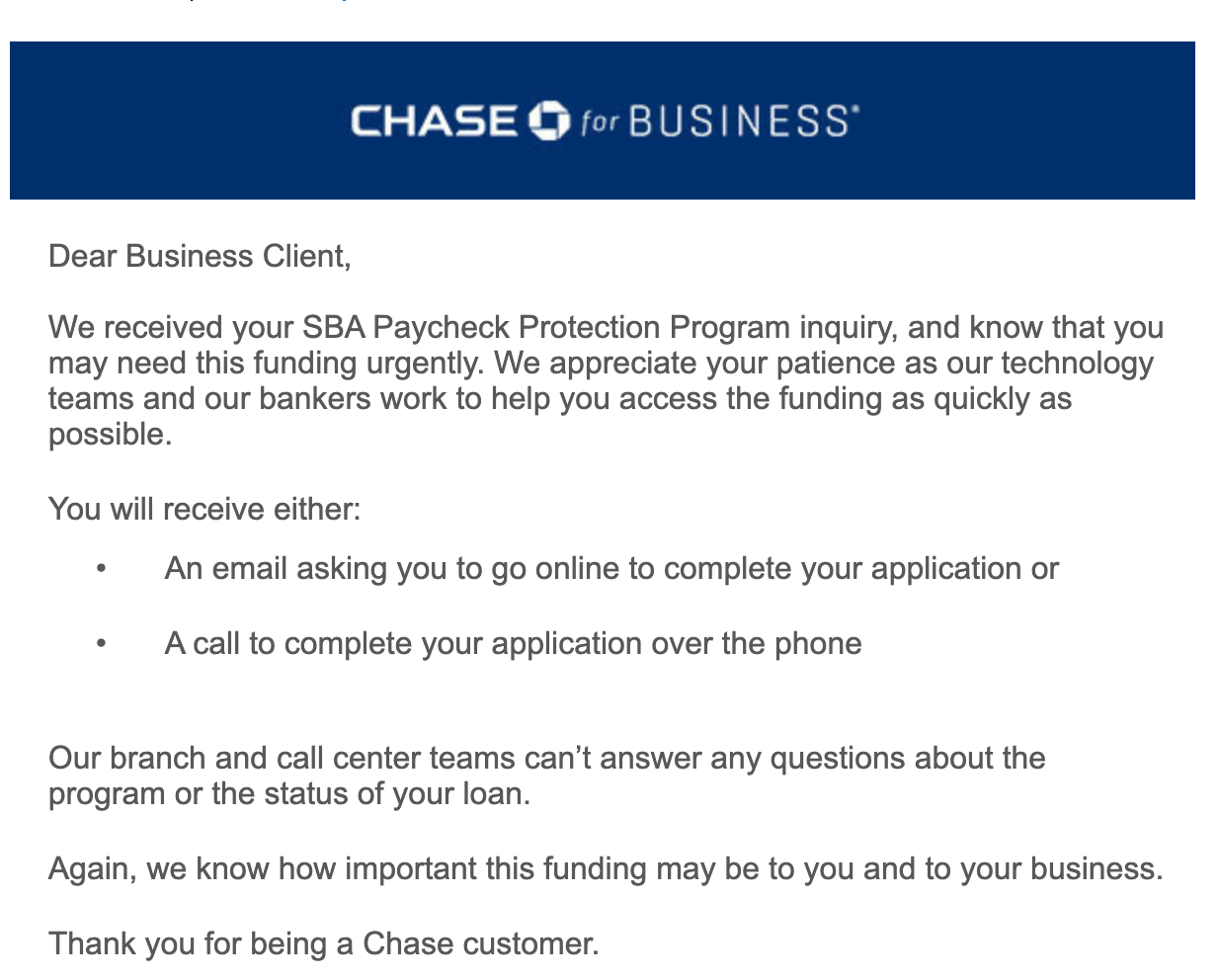

We first recommend talking to your bank. Chase is accepting applications here. If your bank is not accepting applications, Gusto partnered with Cross River Bank to streamline the PPP application process. Here are some other lenders that Gusto has verified are open for PPP applications: Lendio, Fundera

Potential Required Application Documents:

IRS Form 940 and either form 941/944. (If you use Gusto, it can be found in Gusto's Documents on the left side.)

Bank statements for your business account for the last six months that you were in business.

Drivers license for each individual who is at least a 20% business owner.

Voided check for the bank account where you want your PPP loan to be deposited.

2019 Payroll (If you use Gusto, PPP Report: you can get it by clicking "Download you payroll data" above.)

PPP Application BlueVine

Click here to begin application

Steps

Click link and signup:

“Tell Us About Your Business”

Business Name:

Your address, phone number, SSN.

Annual Revenue:

This is the total amount of your income from 2019, add up all your 1099s!

Your Customers:

Entity Type:

Existing Financing: None or if you have anything else put it here

NEXT

Provide Financial Data

Fill out your bank info. You will need your Routing # and account #.

Upload your Feb 2020 bank statement PDF (They use this to show that you received income and were in business in Feb)

Tell Us About Yourself

Name, address, etc.

Title

Ownership (usually 100%)

Add Paycheck Program Details

No prior loan (if you do change this)

Not seasonal

Date you started company (estimate)

Aside from payroll, nothing else. Just leave payroll.

Industry Classification: Choose what fits best

# of W-2 Employees is 0 if you are independent contractor, # if you have them)

Average Monthly Payroll: Take your Annual Revenue / 12 = $x.)

Click Checkbox to “I confirm the amount…”

Click Checkbox to “I certify that…”

Did you get an Economic Injury Disaster: NO

Your loan request should automatically populate

SECTION B: YES to everything

SECTION C: NO, NO

Click checkbox “I understand that…”

FINISH

They will send you a confirmation email, then will ask for additional documents (A Draft 2019 Schedule C form)

Create a Draft 2019 Schedule C form. Since nobody has filed 2019 taxes, they are asking independent contractors to submit a draft form.

FORM to fill out: https://www.irs.gov/pub/irs-pdf/f1040sc.pdf

Line 31 on the form is that everything will be calculated on. Make sure this number is the same as your Total Income you entered everywhere. No need to add in any expenses, this doesn’t get submitted to IRS, it is a draft.

Go back into the dashboard and upload this form.

Wait and cross your fingers! 🤞

Tips from the Community

“Our bank asked for IRS Forms from our payroll company, and pointed to the relatively simple 2 page SBA application that has been circulating.” — Mathieu Young, Founder of The Art of Freelance (4/3/2020)

“At ilovecreatives, we use Gusto for payroll for employees and contractors and Chase bank. Gusto offers an easy downloadable document so you don’t have to contact your accountant. However, when we applied through Chase, it just asked us for our Tax ID Number. Apparently, bankers will be getting training over the weekend about how to actually process the loans.” — Puno, Founder of ilovecreatives (4/3/2020)

“Bank of America asks you a few questions basic questions, but didn’t ask for any forms or payroll information.” — Daniel, Co-Founder of PeopleMap (4/3/2020)

“CITI Bank is working on it, but you can’t start applying right now.” — Geraldine, LCD (4/3/2020)

FAQ

Isn’t it too late to apply for a PPP loan because the money has already run out.

It's very likely that more money will be allotted to the program. Your lender may still be taking applications to submit to the government once more funds become available. We recommend that you apply immediately in order to get in line for the next disbursement of dollars.

What if I haven’t been approved yet?

If you have already applied for a loan but have not yet been approved, it is important that you don't apply again. If you’re curious to learn more on this topic, we recommend referencing the guidance from the SBA (see “Can I apply for more than one PPP loan?”).

When do I have to pay the loan back?

Never, as long as you follow the government guidelines to spend at least 75% of this loan on eligible payroll costs for your team, avoid reducing salaries, and don’t terminate any employees. After eight weeks, the loan is expected to be forgiven and it’s your money to keep.

If you’re unable to uphold the loan forgiveness requirements, don’t worry — your loan payments will be deferred up to six months.

I though I can only get my PPP loan forgiven if I use it for payroll?

Fact: The CARES Act requires that you use 75% of the PPP funds on payroll. The other 25% can be used on qualifying business expenses such as your business rent and utilities or interest on a mortgage.

What if I’ve already had to lay off employees?

You can still include them in your loan amount — and more importantly, bring them back! You’ll just need to re-hire them before June 30, 2020 and keep them on payroll for at least eight weeks.

What if I already got EIDL (see below)?

According to that same article from the US Chamber of Commerce: “Small businesses can get both an EIDL and a Paycheck Protection Program loan as long as they don’t pay for the same expenses. However, be sure to check with your financial advisor or lender before taking both types of loans if you are not sure of the specifics.”

Economic Injury Disaster Loan (EIDL)

Small businesses, freelancers and non-profits who’ve been severely impacted by the Coronavirus (COVID-19) can apply for the Small Business Administration (SBA) "Economic Injury Disaster Loan" (EIDL).

Mathieu spoke with a member of the SBA team (thanks for doin’ the hard work! 👏🏼) and gained some detailed insights. Here’s the deets from his conversation:

What is the “economic injury disaster loan”?

A federal loan program typically reserved for earthquakes and other natural disasters.

If COVID-19 is deemed a National Emergency in your state, you can apply. Check to see if your state has declared it a National Emergency.

Receive up to $2 million in loans with a 3.75% interest rate (but most likely less, depending on your expenses and income).

WHO is eligible

Any type of business, including sole proprietorships.

Freelancers and independent contractors paid via 1099 or W2.

Non-profits.

TO APPLY

Fill out their online application (here’s a step by step). The SBA team will be in contact to communicate the details of your potential loan, and to run the required credit checks and residency verifications. Please note that their team is fielding an unprecedented flood of applications, but if you need income for the next few months, you should apply now, and get in line early.

For more specific assistance, you can contact the SBA office at: 1-800-659-2955. Want a closer look at your state’s loan option? Download these additional fact sheets. EX: California’s is here.

Tips from the Community

“Make sure that you double-check your status! Their system crashed when I applied and they had no way to inform me.” — Geraldine, LCD (4/3/2020)

“Includes an optional Advance grant of $10,000 that you can receive within 3 days of applying, even if you’re later denied, and never have to repay. If you’ve already applied, the SBA says to re-apply w/the short form and opt into Advance!” — Claire Van Holland, CV Ledger (4/3/2020)

“Make sure to check that box saying yes to the $10,000 and enter your banking information.” — Ted from Poketo (4/1/2020)

Unemployment Insurance (UI)

Unemployment Insurance (UI) benefits are being implemented by the individual states, so you should check with yours. California EDD just put out additional news, charts, and video tutorials regarding unemployment benefits, specifically addressing 1099 ICs / self employed people, as well as the extra $600/wk authorized in the CARES Act.

How to Apply

The EDD sounds swamped and the situation still looks a little messy, but it still appears that the best advice is to just apply online as soon as possible.

According to their Coronavirus FAQs page, when filing for your UI claim, you will be asked for your last employer:

If you own your business or are self-employed, you should list yourself as your last employer.

If you are an independent contractor, you should list yourself as your last employer.

If you believe you are misclassified as an independent contractor instead of an employee, you should list the business you contract with as your last employer. Be sure to include:

The employer name, phone number, and address.

Type of work performed.

Dates worked.

Your gross wages and how you were paid (such as hourly or weekly).

If you are a gig worker, you should list your gig employer as your last employer.

Tips from the Community

“It always takes about three (3) weeks for most Californians to receive their first benefit payment if found eligible. And they will contact you for follow up information if they’re not able to verify your employment records. They will put out separate instructions for self employed people that have been denied.

Californians should watch for updates on EDD’s website that will include instructions for workers who may have already applied for benefits and were not found eligible for the regular state-administered UI program.” — Mathieu Young, Founder of The Art of Freelance

Enhanced Unemployment Benefits Under The CARES Act (+$600)

Updated April 13, 2020

On March 27, 2020, the House passed the third and largest of stimulus packages, the Coronavirus Aid, Relief, and Economic Security Act (the Act), or the CARES Act, to help large and small businesses, individuals and families better cope financially with the rapid and relentless ravage that the COVID-19 pandemic has unleashed on the U.S. economy. Among the provisions, the Act provides several types of enhanced unemployment benefits, including:

A flat $600 benefit, which is paid on top of the regular unemployment compensation to which the worker is entitled;

Waiver of any benefit application waiting period, so that workers can apply, and receive benefits, immediately;

Eligibility period expanded from 24 to 36 weeks through 12/31

Self-employed “payroll” evaluated by what you paid in self-employment tax

All of these new benefits are administered by the states through agreements with the Secretary of Labor.

Who’s Eligible?

The self-employed in all 50 states:

Sole proprietors

Single-member LLCs, S-corps & C-corps

Those who’ve been furloughed but are still receiving health insurance

Salaried employees under $100k annually who have had salaries reduced

Hourly workers with partial reductions

What do I need to do?

Nothing! As long as you applied to Unemployment Insurance (above), this will be automatically included.

Tips from the Community

“Remember, this is new! Most states are not set up is not set up to administer self-employed unemployment and the bill only passed last Friday. If you don’t see the answer you expect, keep checking Gusto (state-by-state summary of benefits updated daily)!” — Claire Van Holland, CV Ledger March 31, 2020

“Californians eligible for certification on April 12 began to see the $600/week additional payments provided for under the federal CARES Act today.” — Julie A. Su, California Labor Secretary, April 13, 2020

Pandemic

Unemployment

Assistance (PUA)

Updated May 1st, 2020 🆕

Please Note: If you qualify for PUA and submitted an application before April 28, you must submit a new claim. Any application you submitted before Tuesday, April 28 will not be automatically processed for PUA eligibility.

The PUA program covers workers who do not qualify for regular unemployment compensation, including independent contractors, gig workers, the self-employed, and individuals with insufficient work history to qualify for regular coverage. However, recipients can also include individuals who have exhausted their regular unemployment benefits and extended federal benefits, meaning that traditional employees may apply for PUA after all of their other unemployment benefit options have expired.

Companies that utilize independent contractors and gig workers may consider sharing the information below with those workers.

Each state is different, but here’s how it will work in California:

Who can apply?

Unemployment benefits will be available to independent contractors, gig workers, freelance workers, the self-employed, and other workers who do not ordinarily qualify for unemployment insurance.

You will be required to “certify” for your benefit payments. Certifying is the process of answering basic questions every two weeks that tells us you’re still unemployed and otherwise eligible to continue receiving biweekly payments.

You must also meet one of the following criteria:

They have been diagnosed with COVID-19 or are experiencing symptoms and seeking diagnosis;

A member of their household has been diagnosed with COVID-19;

They have become the primary breadwinner or support for a household after the death of the previous head of the household due to COVID-19;

They are providing care for a family member or household member who has been diagnosed with COVID-19;

They are providing care for a child or other household member whose school or care facility has closed due to COVID-19;

They are unable to reach their place of employment due to a quarantine imposed as a result of COVID-19;

Their place of employment is closed as a result of the COVID-19 emergency;

They are unable to reach their place of employment because a healthcare provider has advised them to self-quarantine due to COVID-19 concerns;

They have been unable to start a job that they were scheduled to commence due to the COVID-19 emergency;

They had to quit their job as a direct result of COVID-19;

They meet any additional criteria established by the Secretary of Labor.

Who cannot apply? An individual meeting the criteria below does not qualify for PUA if they are able to work from home, or if they are receiving paid leave.

How much can I get?

In order to provide benefits as quickly as possible, payments will be issued in phases. If you qualify for PUA, and depending on the effective date of your PUA claim, the initial payments you will receive are as follows:

Phase 1

$167 per week for each week you were unemployed from February 2, 2020 to March 28, 2020 due to a COVID-19 related reason.Phase 2

$167 plus $600 per week for each week you were unemployed from March 29, 2020 to July 25, 2020, due to a COVID-19 related reason (see Enhanced Unemployment Benefits Under The CARES Act above).Phase 3

$167 per week, for each week from July 26, 2020 to December 26, 2020, that you are unemployed due to a COVID-19 related reason, up to a total of 39 weeks (minus any weeks of regular UI and certain extended UI benefits that you have received).

Note: If you qualify for your claim to be backdated to an earlier PUA effective date based on your last day of work, you could receive payment for prior weeks you were unemployed due to COVID-19.

“Once we are able to complete further programming, we will be able to increase the benefit amount to a maximum of $450 per week if you earned more than $17,368 in 2019. This page will be updated with instructions for reporting additional wages for higher weekly payments.” — California EDD, April 27, 2020

When can I get it?

Typically, it will take about a week after you certify before you receive your first benefit payment. If you are eligible for benefits, you may receive your first PUA payment in about two days if you have an existing EDD Debit CardSM (and there are no issues that require a further review of eligibility). New debit cards and checks are mailed within four to seven days. Once you activate the card you can track, use, and transfer your benefit payments.

Cool, when can I apply?

The EDD will take applications for PUA benefits on Tuesday, April 28, 2020 at 10AM PT. Individuals will be able to go to UI Online to self-certify that they meet the COVID-19-related criteria for PUA.

”UI Online and UI Online Mobile are unavailable now thru 5:30am in order to implement changes for the new federal Pandemic Unemployment Assistance (PUA) program. The EDD will be able to take applications for PUA benefits at 10am on Tues., April 28. Info: https://bit.ly/PUAEDD.” - EDD on Twitter (@ca_edd), April 27, 2020“Independent contractors in California will be able to start applying for federally funded unemployment benefits in two weeks and receive payments within 24 to 48 hours. We need two weeks to create this new technology -- set up the system, test it and be able to turn payments around. Once I know the exact date that this one-stop shop is ready, I will let you know.” — Julie A. Su (@JulieSuCA), California Labor Secretary, April 13, 2020

What do I need to file?

Proof of Citizenship — You must be authorized to work in the US to receive benefits. If you are not a US citizen, have information from your employment authorization ready.

Information About Your Employment History

Employment history from the last 18 months, including the name of the company or companies as they appear on your paycheck, the dates of employment, hours worked per week, gross wages earned, hourly rate of pay, and the reason you are no longer working.

Specific information from your last employer or company, including mailing address, phone number, supervisor’s name, total gross wages for the last week you worked, and the reason for your change in employment.

Then what?

Step 1 – Monitor Email and Postal Service so you can setup your online account.

Look for an email from EDD with a subject line of “New Online Account Created”.

If you have not filed a UI claim in the past several years, you will receive your letter with an EDD Customer Account Number in the mail.

Step 2 – Certify for Benefits

Certifying is the process of answering basic questions every two weeks that tells us you’re still unemployed and otherwise eligible to continue receiving biweekly payments.

One of the questions asks if you're looking for work. Answer truthfully. Given the unique economic situation and lack of available work due to COVID-19, we have been able to adjust our usual eligibility requirements to automatically process more claims. You will not be penalized if you answer “No” to the question about looking for work and will be paid benefits for that week if you meet all other eligibility requirements.

Step 3 – Check Your UI Online Account

As long as you remain unemployed and eligible for benefits, log in to your UI Online account to check for updates. This includes your benefit payments and important notices including when it’s time to certify for your next two weeks of benefits.

Once you receive your EDD Debit CardSM, payments should be posted to your EDD Debit Card in about three days after we receive your certification. Benefit payments by check will take an additional few day to arrive through the mail. More info.

Economic Impact Payment (EIP)

Due to the CARES Act, many people can expect to receive financial relief from the government in the form of a stimulus payment (also known as Economic Impact Payment or EIP) via direct deposit or physical check.

Who is eligible?

Single filers who earn less than $75,000 per year will receive $1,200, plus $500 per dependent child. Those earning between $75,000 and $99,000 will receive a smaller amount depending on their income.

Joint filers earning $150,000 or less in annual income qualify for $2,400 per couple, while annual incomes of $198,000 or less may qualify for a partial payment.

Social Security recipients and railroad retirees are also eligible to receive the stimulus payment and aren’t required to file a tax form.

Other circumstances could affect your benefit, including whether or not you have filed your 2019 tax return. Read more

How can you receive the payment?

If you received your 2019 tax refund from the IRS via direct deposit, your stimulus payment will be electronically deposited into the same account.

If you haven’t filed your 2019 taxes but received your 2018 refund via direct deposit, your stimulus payment will be electronically deposited into the same account.

If you received a physical check for your last tax refund, you can expect a physical check for the stimulus payment.

The IRS will start accepting direct deposit information online in the coming weeks. Watch the IRS website for updates.

Long story short: Most people will have it automatically deposited by the IRS, but you should do some research to make sure you don’t need to fill out any paperwork to receive your check.

Loan Deferment

vs. Forbearance

With everything going on right now, many student, auto, and housing loan companies are offering their customers deferment or forbearance options. While both could be helpful, it is important to understand the distinction!

As part of the $2 trillion CARES Act, people with federally held federal student loans are getting an automatic forbearance until the end of September (Sept 30.) People who have mortgages under the CARES Act can put their housing payments in forbearance for up to a year if you’ve been laid off or lost work owing to COVID-19.

However, “The problem with the CARES Act is that it doesn’t make clear how borrowers pay back the money during a forbearance period,” says Shamus Roller, executive director at National Housing Law Project, a nonprofit legal advocacy center.

Difference between forbearance & deferment

If you’re like ‘what exactly is deferment?’ it means your payments have been put on pause, and no interest will accrue on the balance of your loan during a set period of time. It also means that not making payments will not negatively affect your credit score. If you’re able to make payments during a period of deferment, it is suggested.

A forbearance on your loans mean that interest does accrue towards your principle loan balance, although missed payments will not negatively affect your credit score. One of the common misconceptions is that using deferment or forbearance will have a negative effect on your credit score. It will not.

Long story short: Deferment is preferred as you’re not adding interest — which is compounding.

It is important to ask your loan provider what are the stipulations for both your forbearance and your deferments.

While forbearance can offer temporary relieve, some banks have not figured out how to incorporate the CARES Act into how they approach repayments. For example, Wells Fargo, Bank of America and Chase have told them they have to repay those postponed payments – known as forbearance – in a lump sum once three months are up.

I.E. if you receive a 3 month forbearance, make sure on the 4th month you’re not required to pay x4 of your monthly payment to catch up.

Loan providers must let you know how much interest will accrue over the course of a forbearance, so make sure to ask for what your total balance will be when your loan resumes.

Long story short: Forbearance payments can sneak up on you.

Not sure if your loan provider is offering options? Ask!

Even if your private loan provider is not offering options publicly, it’s important to reach out and know your options. Let them know what federal loan providers are offering, and ask if they’re able to match. Some companies are willing to work with you through these tough times. Transparency and communication are key.

ilovecreatives guide:

applying for unemployment

Updated May 1st, 2020 🆕

Unemployment Guide Directory ☎️

Who can file for unemployment?

Economy Workers / Independent Contractors

Introduction

General Information

Layoff vs. Furloughed

Unemployment Application Checklist

Tab Guide

How to file a claim

If you haven’t filed your 2019 taxes, the government recommends that you do so as soon as you can. If you’re looking for a tax expert, we’ve done the accountant courting so you don’t have to! Daniel is pretty dang great, and he specializes in working with creatives, so he knows the deal.

While your maximum benefit amount for UI is determined by state (in California, it’s $450 per week), the Federal Stimulus adds $600 (per week) on top of what your state issues you for up to 4 months until July 31, 2020. After that golden period, your total benefit will go back to that state-determined amount.

CNBC reports that this is a massive jump from when benefits only increased by $25 following the Great Recession. Additionally, this relief package will extend your state’s maximum of benefit weeks by 13 weeks. This means up to a total of 39 weeks when you can be receiving money, but will still vary by state.

What has your experience been with filing for unemployment? We want to hear from you! 👂

Who Can File for Unemployment?

In response to the COVID19 pandemic, Congress has significantly expanded who can apply for unemployment insurance as part of its $2 trillion CARES Act, signed into law by President Trump.

Prior to this new law, self-employed individuals could not receive unemployment benefits. The new law, however, created a program called Pandemic Unemployment Assistance for freelancers, independent contractors, or gig economy workers who were previously ineligible for unemployment insurance. This program, once operational, will include:

Up to 39 weeks of benefits starting with weeks of unemployment beginning February 2, 2020, through the week ending December 31, 2020, depending on when you became directly impacted by the pandemic.

An additional $600 to each Pandemic Unemployment Assistance weekly benefit amount you may be eligible to receive, as part of the separate CARES Act Pandemic Additional Compensation program. Only the weeks of a claim between March 29 and July 31 are eligible for the extra $600 payments.

Unfortunately, undocumented immigrants are not eligible, and neither are new employees to the workforce, like recent college graduates, because they don’t have a long enough work history to apply for benefits. Even if you don’t think you’ll qualify, however, it is worth applying because the new laws have dramatically expanded who can apply.

How is the process different for gig economy workers or independent contractors?

Gig economy workers, freelancers, and independent contractors will apply for unemployment insurance through the new program called Pandemic Unemployment Assistance, which is currently being set up by the Labor Department. Unfortunately, this could take longer to get ready. Once the program becomes available, Californians can apply through the Employment Development Department website (edd.ca.gov) where regular employees file for unemployment.

Freelancers will need to provide whatever documentation they can to prove their wages, including, invoices, old tax returns, etc. Good-faith attestations are available for freelancers, but documentation will be preferred.

Introduction

We’re living in a time of uncertainty, and what is more uncertain than applying for unemployment (government websites?!)? With all the mystery around applying, the process can be intimidating. But don’t sweat it! 💦 We’ve got you!

Disclaimer: Before you dive into this guide, please keep in mind that we’re a resource for creatives, and not a legal entity. While we’ve done our best to make sure this information is accurate, please feel free to reach out if you have any corrections hello@ilovecreatives.com

Big thanks to our friend Melanie Loon for putting together this guide! Melanie and the rest of the ilovecreatives crew are hugging you right now (metaphorically, because 6-feet and all that)

Also, many people are reporting site crashes as lots of us flood the system (at this point, more than 22 million of us in the U.S.). Keep a notes app open to copy over information or frequently screenshot as you gather information (we recommend Cloud App!) — That way if the site crashes you won’t be like Liz Lemon here. 👇

Since there is a large influx of people applying each day, consider applying online from the hours of 7AM - 10AM and 9PM - 12AM during the evenings.

If you’re calling in, since Mondays and Tuesdays are the busiest days of the week, Thursdays and Fridays could be the least busy. The best time to call is between 10:00 AM and noon or between 1:00 PM and 3:00 PM.

Unfortunately, with the large influx in claims, there is no sure-fire time that is best to apply.

Hi friends!

My name is Melanie Loon ✨

Feel free to say hey 👋 (@melaniespoon), I’m a writer and illustrator here in LA. I did this, two years ago, after a really heart-wrenching layoff, and as I apply now under a furlough, it is strange not to be a stranger to edd.ca.gov.

That’s right, I don’t need to register for an account, I’m logging in.

So if this is your first time navigating the process, welcome! I’m here for you.

How to get started?

In my experience, the first hurdle is an emotional one, but the second is just trying to understand what information is required of you to access the financial support you need. If you’ve been laid off, or, now, had your hours reduced due to COVID-19, this is support you’re entitled to.

I actually found it sort of reassuring that the process is very step-by-step (no skipping ahead!). It speaks a little to the guidance your state is willing to offer to get you back on track, even if it doesn’t feel like it. This takes the form of a billion little fields to fill out (kidding) and in some cases requiring you to create a profile on your state’s jobs site.

But you’re a creative; a self-starter, a slashie, and all that strength you’ve built up over the years has prepared you for this. Crack those knuckles, you’ve got this!

Since this isn’t my first rodeo, I’m going to walk you through with my take on things.

Let’s get you that unemployment! 💸

General Information

Applying for unemployment might feel tedious, but it is necessary and part of your rights as an employee.

Unemployment insurance (UI) is not mystery money the government is hiding away.

The U.S. Department of Labor funds this through UI taxes paid by employers and collected by the state and federal government, meaning your employer has already paid this out, and won’t lose more money when you file a claim.

As the Century Foundation (a public policy research institute) puts it, “Unemployment insurance is paid out of dedicated state trust fund accounts financed by employer contributions. States set the amount of benefits, and the amount of contributions by employers needed to pay those benefits.”

Benefit amounts you collect from unemployment insurance is taxable income, so if you can save a portion, do what you can.

State Maximums for Benefits

Layoff vs. Furlough

If you’ve been laid off, you’ve lost your job through no fault of your own, whether it be downsizing, a rough financial situation at the company, or some other sort of change that eliminates your position.

In a furlough, your hours have been reduced significantly, again, through no fault of your own. The difference here is that you remain an employee of your company, and your employer intends to bring you back up to full hours once things return to normal or the company gains better stability.

After filing, you’ll likely be told to make a profile on a state jobs site (this isn’t for getting a government job) as part of efforts to gain new employment: CalJobs for California. When you fill in your information on CalJobs, it creates a resume and asks you to list skills from a bank of categories.

I already had a profile from the first time I applied for UI post-layoff, so I just needed to update mine.

States determine if they generally include part-time workers in unemployment insurance.

In the case of the current COVID-19 outbreak, the CARES Act passed in March 2020, brings part-time, gig workers, and independent contractors into the mix.

COVID-19 Circumstances

Our state employment services are being unusually impacted by:

Steep increase in need for services

Very new federal guidelines based on the Federal Stimulus and direction from the U.S. Department of Labor (CARES Act)

It typically takes about 3 weeks to process a claim for unemployment benefits and issue payment to most eligible workers.

This being said, if you don’t receive a quick answer from your employment service, this doesn’t necessarily mean your claim isn’t being worked on. All offices are asking for patience amidst the influx. Check to see if your state is trying to schedule out what day of the week you can apply based on where your last name is in the alphabet, or by the last digit of your social security number. Your state likely has a page adding updates as they come in as related to the virus.

This one is California’s.

Self Employed

One interesting note EDD says is that sometimes you may think you're an independent contractor of a biz but actually you're part-time. In this case you should look into if you qualify for benefits from your employer OR even a past employer - Hence the whole reporting of evvvveryone you've earned money from in the last 18 months.

Federal Stimulus

So what about that UNIVERSAL 👏🏼 BASIC 👏🏼 INCOME? Kidding, but not really. No matter which state you’re in, the method for calculating how much you’ll receive is the same. Here’s a calculator.

While UI is taxable (meaning, the IRS will count the money you receive as your income, so if you’re able to put a portion of your weekly allowance into savings, try to!), the federal stimulus checks set to be issued soon are not!

There are quite a few calculators online to determine how much you should expect (based on your 2019 tax filing). Here’s a calculator to help you determine how much you’ll receive.

If you’ve provided your bank information to the IRS, you’ll receive this by direct deposit, just as you would have received your tax return this way.

If you haven’t filed your 2019 taxes, the government recommends that you do so as soon as you can. If you’re looking for a tax expert, we’ve done the accountant courting so you don’t have to! Daniel is pretty dang great, and he specializes in working with creatives, so he knows the deal.

While your maximum benefit amount for UI is determined by state (in California, it’s $450 per week), the Federal Stimulus adds $600 (per week) on top of what your state issues you for up to 4 months until July 31, 2020. After that golden period, your total benefit will go back to that state-determined amount.

CNBC reports that this is a massive jump from when benefits only increased by $25 following the Great Recession. Additionally, this relief package will extend your state’s maximum of benefit weeks by 13 weeks. This means up to a total of 39 weeks when you can be receiving money, but will still vary by state.

Layoff vs Furlough

Once you receive notice of a lay-off, apply ASAP for unemployment insurance. The government isn’t going to come down on you if you don’t apply right after losing your job, but applying sooner means getting approval sooner for benefit payments.

In normal circumstances, you’ll need to look for other work and report on how it’s going every 2 weeks. This is “certifying” for benefits: basically confirming you’re still in need of the assistance and are working towards obtaining a new job.

In the current circumstances, you won’t be required to report on work searches. Marking “no” when asked if you searched for work will not penalize your benefits. When the option is available on drop-down menus and fields to fill in, make sure that if you’ve lost your job because of COVID-19, you cite it as the reason.

Furlough

Once you receive notice of your hours being reduced, apply ASAP for unemployment insurance. If you don’t apply ASAP, you run the risk of delayed benefit payments.

Again, a furlough is a temporary situation where you continue to have an official working relationship with your employer, with the intention of restoring regular hours once possible. Because of this, you won’t be required to look for other jobs and report about this to your state employment service.

In California, for the period you’ll be working under reduced hours, your employer will need to submit a form every week regarding your earnings.

You’ll then in turn fill out the claimant’s section, mostly confirming whether there was any reason besides the lack of work available that you couldn’t work full time, and reporting any wages earned outside of this job.

If your employer hasn’t already given you one or notice of one, ask for a Notice of Reduced Earnings. In California, this is Form DE 2063.

Instructions should be listed on your state’s employment development website, but your method of submitting this information to the state department will vary based on whether you’ve established a claim in the last 12 months.

Checklist

How to Apply for UI Benefits (File a Claim) (YouTube) English | Spanish | Cantonese | Vietnamese | Mandarin

Your state’s unemployment office should link a PDF to pieces of information you should have ready to apply online.

Here is California’s

You’ll need this whether you apply based on a layoff or furlough.

General Guidelines

In California, the Employment Development Department (EDD) lists:

Your Information

Social Security Number

Name (Including prior names, like married or maiden names)

Mailing Address

Telephone Number

Driver’s License or ID Card Number

Alien Registration Number and Expiration Date, if not a citizen

DD Form if you’ve served in the military in the last 18 months

Last Employer Information

The last employer is the business or company you last physically worked for or could still be working for part-time

Name of company as it appears on your paycheck or W-2 Form (Not a DBA, but could be a payroll agency or staffing agency)

Complete mailing address including zip code and physical location

Company’s phone number and your direct supervisor’s name

Reason for working reduced hours or for no longer working with the employer (This will be a dropdown menu choice)

Employment History (ALL Employers in the last 18 months, including your last employer)

Ok, creatives, listen up — THIS is what took the longest for me, and will likely be something you’ll want to take time to gather for easy access.

Name of ALL employers as they appear on your paycheck or W-2 Form

Period of employment (Start and end dates)

Wages earned and how you were paid (as in, hourly, weekly, monthly, but these online forms usually favor asking your wage rate in hourly terms, not salary or piece rates, so keep this in mind for the calculator you should have next to you.

If you’re not sure about this information, check bank statements — most banks allow you to filter transactions by dates.

Tab Guide

Now here’s my take on the tabs you should have open:

All pieces of I.D. info above

Your W-2 forms

Browser tabs open for whatever payroll software your employer uses

This is for finding your earnings per quarter if your wages aren’t exactly the same every month. (Mind that you’ll need to make sure you’re looking for gross wages, NOT net wages, so look here and not in your bank statements for direct deposit amounts).

This platform will also have your W-2 digitally if you can’t find the paper form quickly.

A calculator (I needed it)

A notes app open

Many people are reporting site crashes as lots of us flood the system (at this point, about 6.6 million of us). Keep a notes app open to copy over information or frequently screenshot as you gather information.

When clicking through pages of questions, sometimes when you save your progress on a “sub-page,” it will not save every field unless you’ve made it to completion of your filing.

In the meantime:

It’s really easy to see this time as one long nebulous cloud. It helped me during my first season of full unemployment to keep track of all the little projects, new workshops, and people I got to meet or mentor. This time is not wasted. Keep it as a note in your computer and add links to things you read that change your perspective. Write down how.

“I was laid off back in 2008. It was scary, ⅔ of the our advertising agency were laid off in a few weeks. I ended up doing unemployment for about 2 months and started to find new types of freelance work. Specifically UX Design! My husband’s boss knew I was looking for work and helped me figure out how to get the job. After a lot of hard work, I became a UX Director and then quit and then ended up here! Haha, it’s all beautifully unpredictable and wild - this non-path path is made for creatives.

I know it sucks right now and if it truly is bad for you, please reach out to us. Reaching out for help is the best thing to do right now. Even if you’re looking for work or just need to vent! It’s not insensitive and you never know where it might lead.””

As you say yes to new things to learn and new things to volunteer for (new recipes to try?) keep track. Find out and evaluate what does and doesn't work for you. Like say, for me, I can’t commit to e-courses without a strong community element, but I know that now!

As one piece of encouragement on the interwebs reads:

“In the rush to return to normal, use this time to consider which parts of normal are worth rushing back to.”

Use this time to find new footing. You absolutely can. 😊

Honestly, you may look back like I am and get excited that the proof is right there — you’re strong, adaptable, and worth a lot more as a whole human being in progress vs. any job title you’ve held.

How to File a Claim

Basic Step by Step

You can file 3 ways: Online, By Phone, or By Fax/Mail

Online is always recommended for speed/convenience.

File as soon ASAP when you get laid off or have your hours reduced during COVID-19.

Your claim begins on the Sunday of the week you file your application.

Phone lines are currently pretty unreliable to get through to, as a national experience. Complete what you can online first.

Create an account online.

Go to your state’s employment development site, most likely under “Register for a benefit program.”

2.File a new claim.

You’ll need to have those pieces of ID ready, with info about how much you’ve earned over the past 12 months, by quarter.

You should have received a Notice of Reduced Earnings Form and/or a Notice of Change in Relationship form from your employer, but you won’t need it for creating an online account.

Submit your claim!

You might not receive a confirmation email for this. Keep the link to your account handy — This is where info will be updated most often.

You’ll receive a confirmation of your claim submitted via mail.

You can either certify by mail, phone, or online, but again online is best. If any info you receive is incorrect, you’re advised to call

Certify for benefits!

By this time you’ll receive regular email notifications when it’s time to certify. You’ll need to do this as long as you continue to need the benefits up until the end of the current claim you’ve opened.

If working on reduced hours, cite Covid-19 as the reason. In the same form you’ll be submitting: how many hours you worked, for what employers, and how much you earned in a single week.

You’ll receive payments via a debit card (Bank of America).

As long as you’re certifying, you’ll receive benefits deposited into this card.

Kudos to you, Mathieu, Melanie, and our community, for all this info! If you have any experience with any of these or have other resources & tips to share during this time, we’d love to hear from you! Hit us up by emailing us at hello@ilovecreatives.com.

Sharing is caring, and we’re so grateful to have such a supportive, creative community! 🤗