Health Insurance for Freelancers Guide

Health Insurance for Freelancers Guide

How do you get Health insurance as a freelancer and which plan makes the most sense.

We made this guide with the help of Dr. Noor Ali, a medical doctor and licensed health insurance advisor, to demystify all the lingo and answer FAQs from freelancers.

TLDR?! We get it, just book a free 15 minute consultation with Dr. Noor here.

When is it time to get

Health Insurance as a Freelancer?

I was surprised, but also not surprised to find out that in 2019, 24% of full-time freelancers in the United States reported having health insurance and 7% of freelancers had health insurance through their parents' plan (source Statista). I’m pretty sure all freelancers want health insurance, but it’s just so damn complicated! 😖 And after talking to a few people, it just sounds like something you can’t afford.

Dear Freelancers, the time to get health insurance is when you don’t have it. If you are under 27 and can get on your parent’s plan, do it. If you make under $40K, there’s The Affordable Care Act (see below). If you make over $40K and are pretty healthy, your insurance is probably ~$200/mo (depending on your dealbreakers, see below). Dental and vision could be ~$10-50/mo. Waiting till you can afford insurance is the biggest signal that you most definitely need it now.

Also, once you turn 27, your body turns on you. Yeesh, I went 2 years without seeing a gynecologist and found out I had a lump in my breast and fibroids and endometriosis. I’m fine now, but that whole process was long and spensy (I ended up getting surgery, too).

The point is you never know when something is going to happen. Plus, you deserve to have a healthy body and a peace of mind.

— Puno, Founder of ilovecreatives

Find the Health Insurance Plan that makes sense for you with Dr. Noor

Book a free 15 minute consult with Dr. Noor here.

Note: Dr. Noor Ali is licensed to provide quotes and consultations in 33 states (AL, AR, AZ, CO, DE, FL, GA, IA, IL, IN, KS, KY, LA, MD, MI, MO, MS, MT, NC, NE, NV, OH, OK, PA, SC, SD, TN, TX, UT, VA, WI, WV, WY). If you live in another state (AK, CA, CT, DE, HI, ID, MA, ME, MN, ND, NH, NJ, NM, NY, OR, RI, VT, WA) or DC, please visit healthcare.gov to learn about healthcare plans available to you.

❝I had been struggling to find affordable decent healthcare for years. Stuck with options I didn't understand or didn't make sense for me, I had pretty much given up, until I was introduced to Noor. In one simple call, Noor was able to break down years of confusion and find options that were not only in my budget, but were great healthcare options! I am SO grateful for her. Noor is kind, understanding and very well versed in the industry. I would highly recommend her for anyone looking for healthcare options!❞ — Allison Ullo

❝Noor is a lifesaver! Time is precious and Noor saved me from hours of health insurance research. She walked me through my options in an easy to understand dialogue that was real and made a normally unenjoyable process a very seamless experience. We found the perfect, affordable option for my personal needs with options for employees as my company grows in the future. Highly recommend :) Thanks, Noor!❞ — Sara Spiegel

Table of Contents

What’s a premium?

What’s a deductible?

What’s a copay?

What’s a cap?

Types of Markets

Types of Networks

Freelancer FAQs

How do I decide between plans?

How does open enrollment work?

Should I look for a doctor or healthcare plan first?

Can I refuse an employer-offered plan?

Do I need to offer health insurance?

What if I travel a lot for work?

Can I write off health insurance?

I have a pre-existing condition and/or I am pregnant

I’m still on my parents’ plan and 26

I am 60+ years old and without coverage

Healthcare

Terms

Before we start, we gotta get all this lingo down. Check your knowledge of these health insurance terms.

What’s a premium?

The premium is the price of your health insurance policy. You typically pay this monthly or quarterly. It’s the bill before the bill.

If you have health insurance through an employer, it’s usually taken out of your paycheck. If you’re self-employed, you might set up an automatic payment. You have to pay this regardless of whether you go to the doctor or not (although you should take advantage of what you’re already paying for 😉).

What’s a deductible?

This is the money you agree to pay to your health insurance company before your insurance company starts to pay. This is a confusing one because you’re probably thinking, wait… aren’t they supposed to cover me?

You usually get one deductible per policy (e.g. healthcare, dental).

After you “meet/pay” your deductible, you are eligible for the benefits in your policy.

Your deductible is separate from your Premium.

Example Cost Breakdown:

Let’s say your premium is $240/mo ($2400) and your plan’s deductible is $2000💰

You have to schedule an emergency surgery that’s $10K

Your policy states that 100% of costs are covered after the deductible is met, so insurance will cover the remaining $8K.

What you’ll pay: $4,400 ($2400 + $2K)

What insurance will pay: $8K ($10K - $2K = $8K)

Post-Surgery: $0. Since you met your deductible, you’ll only have to pay the copay (more on that soon) and your monthly premium.

What’s a copay?

The fixed fee you pay to receive insurance-covered care.

Your copay is what you end up paying your doctor, dentist, etc. to receive care. It’s often at a reduced rate than what they would charge without insurance — which is why this feels like such a great deal! 😉

What’s a cap?

No, it’s not a clap with a silent “L”. The cap is the max amount of money your insurance will pay for your healthcare.

No one wants to file for bankruptcy over medical bills, but it happens. 😢Your cap gives a good indication of how much protection you have (example: 1 million dollars worth of medical costs! ). Some people have an unlimited cap, but you pay in other limits and exclusions.

Types of

Healthcare Markets

As a freelancer, you can choose between plans on the Public Market (i.e. The Affordable Care Act, Medicaid, CHIP) vs. Private Market (i.e. Blue Cross, Oscar, etc.).

Before we even get into the EPO, PPOoooo’s, you might have some dealbreakers and/or qualify for help from the government. Check out the chart below to see what matters to you.

Public Market Plans

The Affordable Care Act (ACA aka Obamacare) was signed into law in 2010 to provide accessible insurance in this marketplace. Medicaid is a state and federal program that provides coverage if you have a very low income ($16-$20k max/year). CHIP (Children's Health Insurance Program) provides coverage for families who don’t qualify for Private Market Plans but are ineligible for Medicaid. Each state has its own public marketplace. For example, Covered California™ is the health insurance marketplace for California.

How it works:

You qualify if you make under $40k per year or are unemployed

You’ll get a tax credit to offset your income

Low cost, but less flexibility, offerings, and doctors

Private Market Plans

This is the most common market! You can choose between Short-Term and Long-Term Plans:

Short-Term (under a year): Think of these as “gap coverage.” This can be a great option if you are between jobs or your new job has a long waiting period and you need something to fill that “gap”.

Long-Term: Most plans

How it works:

You make over $40k per year or are unemployed

You are offered a plan through your employer

Plans can be sliced & diced thousands of ways 🥒

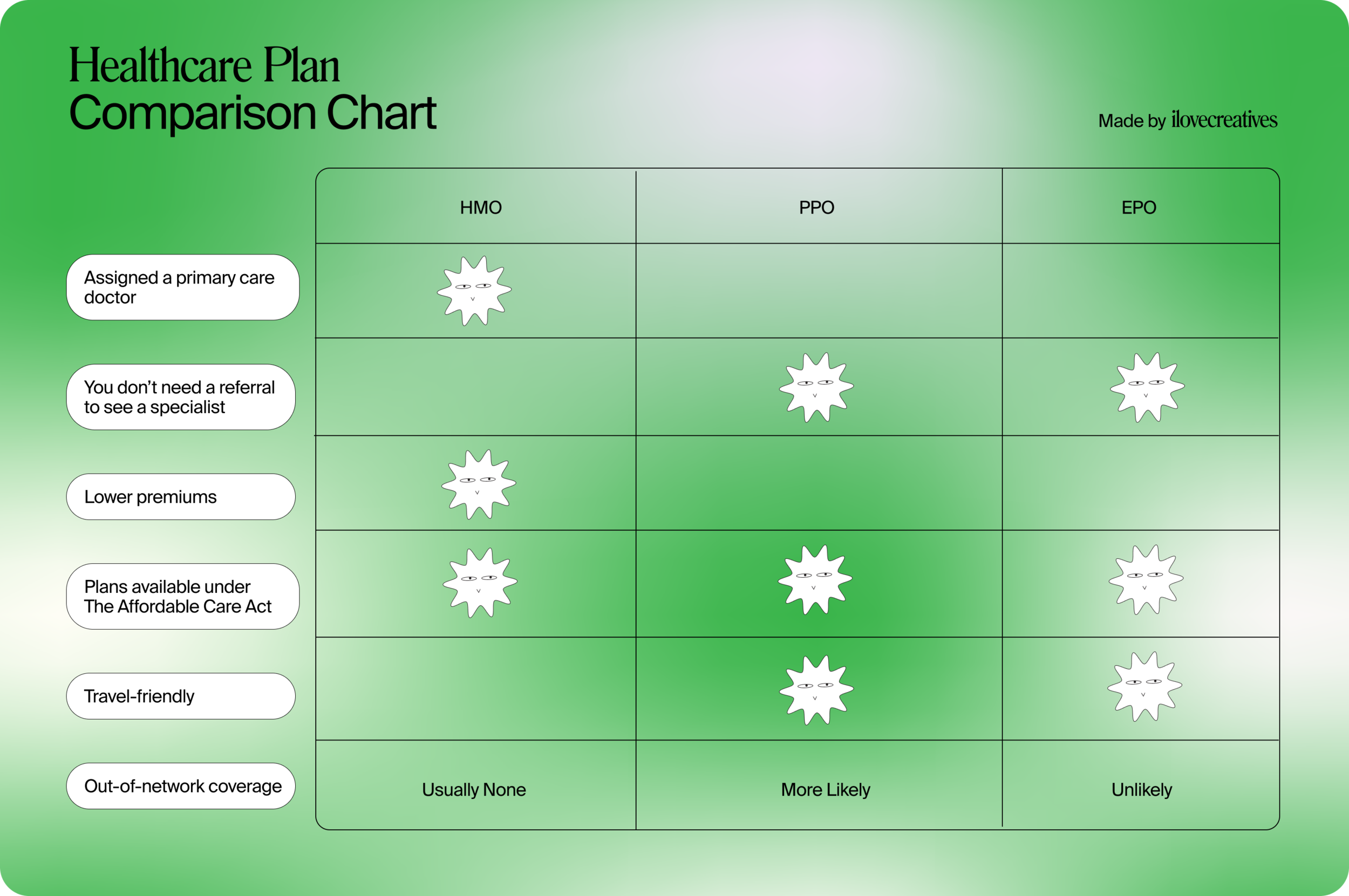

HMO vs. PPO vs. EPO

What do all the “ohs” mean?! These acronyms stand for the main types of plans, aka networks.

Most insurance companies offer one or more of these options within each market. This is where it gets super confusing! If you’re unsure, book a free 15 minute call with Dr. Noor.

Health Maintenance Org (HMO):

Budget-Friendly, but in-network

Example: Kaiser

You can only go to a doctor under contract with that HMO

You or your employer pay a fixed monthly fee for services within the HMO network

You will be assigned a primary care doctor who will act as your “gatekeeper”

You can only see a specialist with a referral slip from your assigned primary care physician (PCP)

Tend to be cheaper

Lower premiums + deductibles, less flexibility

Out-of-network

Preferred Provider Org (PPO):

Freedom of choice: in or out of network

Example: Blue Shield, Aetna, Cigna

You or your employer get an in-network discount if you use physicians within the plan

You can go out of network but you’ll pay more

You can see any specialist you want to

Travel-friendly

Larger network, nationwide coverage

Offers coverage for out of network providers

Exclusive Provider Org (EPO):

Budget-friendly, no referrals

Similar to an HMO, coverage only applies if you go to doctors, specialists, or hospitals in the plan's network (except in an emergency)

No out-of-network benefits

Higher premiums than HMOs, but lower than PPOs

Referrals not necessary

Generally lower rates

Insurance FAQs

+ How do I decide between plans?

Great question! From Noor: "Once you know your plan type (HMO/PPO/EPO) and if you qualify for subsidized coverage, head to your state's health insurance marketplace. Then input your info. It'll probably show you a bajillion plans! Or you can just chat with me and I can walk you through it!"

Next, take some deep breaths. You've got this! You'll see plans organized by four categories: Bronze, Silver, Gold, and Platinum. These are based on the % you vs. the insurance company pay for your care. It doesn't relate to the quality of your care (more info can be found on Healthcare.gov).

- Bronze 🧡= Lowest upfront costs, higher costs for routine or emergency care.

- Silver ♡ = Moderate upfront costs, some of routine care covered.

- Gold 💛= High upfront costs, good if you use a lot of care.

- Platinum🤍 = Highest upfront costs, lowest costs for care. Great if you need a lot of care.

How do you pick? Remember the terms? Compare the Premium, Deductible, and plan type (HMO/PPO/EPO). Here's what the page might look like:

+ How does open enrollment work?

Open enrollment is the yearly period when you can enroll in a health insurance plan or change your plan.

If you qualify for the Special Enrollment Period, you can get coverage at any time. You may qualify due:

- To a qualifying life event (getting married, having a baby, moving, or losing coverage)

- New job

- You've turned 26 and are no longer on your parent's plan

More info on Healthcare.gov.

+ Should I look for a doctor or a healthcare plan first?

It depends on your dealbreakers!

If you have a specific doctor you want to see, see what insurance they accept, and ask for a list of estimated out-of-pocket costs. This can help you decide (1) whether they accept a plan you'd want (2) what it would cost you out of network, should you pick a plan that's not covered.

If you don't have a specific doctor you want to see, are relatively healthy and care more about cost-saving, then picking the plan first may be best.

Most insurance marketplaces have a search option where you can research doctors and specialist. If that feels overwhelming, ask your network! We've even asked for recs through an Instagram Story, it happens.

+ Can I refuse an employer-offered plan?

Yes, you can! If they offer a plan, you’ll want to seriously consider it. Employers will usually pay a portion of your premium (82% on average!) If you decline and would rather pay on your own, you can enroll in The Affordable Care Act or a private market plan. You likely won’t qualify for the subsidies, but you could have more control over your healthcare costs.

You could also negotiate a payout, so your employer pays a portion of your premium with your paycheck. This lets you keep your healthcare separate from work, while still getting the benefits.

+ I am self-employed and have employees. Do I need to offer health insurance?

No law directly requires employers to provide health care coverage to their employees. Under the ACA, employers with 50 or more full-time employees (or the equivalent in part-time employees) must provide health insurance to 95% of their full-time employees or pay a penalty to the IRS.

Unfortunately, there isn't a benefit for micro businesses to get health insurance. You don't get a discount just because you're a business. However, offering health insurance is definitely a benefit to some employees.

From Puno: "I'm a BIG fan of Gusto. It's super easy to setup and can help you build health insurance packages. They do everything from payroll taxes to filing 1099s for contractors to health benefits for small businesses! If you're taking a salary as an LLC or S-Corp, but don't have employees, you should still sign up for Gusto. It's worth the cost."

If you have under 25 FT employees, you can also apply for the Small Business Health Options Program (SHOP) tax credit. Talk to a CPA who can help you set this up.

+ Can I write-off health insurance as an expense?

Yes! If you’re a freelancer paying out of pocket, you can do this. Hit up your CPA come tax time and ask about the Self-Employed Health Insurance Deduction. If you qualify (i.e. have no other insurance options + have business income), you can deduct 100%. This only applies to federal, state, and local income taxes — not to self-employment taxes.

+ What if I travel a lot for work?

If you plan on using your health insurance across multiple states, Private Market plans will be best — even if you qualify for The Affordable Care Act (make under $40k). If you travel as a freelancer, The Affordable Care Act plans don’t allow you to see a doctor out-of-network or out of state. Most Private Market plans, on the other hand, offer the most flexibility and could cover healthcare costs when you’re out of state. This is the power of a PPO.

+ I have a pre-existing condition and/or am pregnant. How does this affect my insurance plan?

Thanks to The Affordable Care Act, no insurance plan can reject you, charge you more, or refuse to pay for healthcare for any condition you had before your coverage started. 😅Once you’re enrolled, the plan can’t deny you coverage or raise your rates based only on your health. In summary, these plans are “guaranteed issue”.

IF you enrolled in your current plan before 2010, you have a “grandfathered” plan. Congrats, bud. These are hard to come by BUT they CAN cancel your coverage or charge you more — so look out. 👀

+ I'm still on my parents' plan, but about to turn 26 and lose coverage.

No worries, it’s time to adult and we GOT you. If you don’t get health benefits options from your employer, your options at this point really depend on how much money you make and your general health status. Talking to a licensed health advisor (don’t worry, it’s free) can help you figure out which plan is best.

+ I am 60+ years old and without coverage.

You are SO CLOSE to Medicare….but not there yet. If you don’t get health benefits options from your employer, your options are this point really depend on how much money you make and your general health status. Talking to a licensed health advisor (don’t worry, it’s free) can help you figure out which plan is best.